MuleSoft's securing by Salesforce in March for $6.5 billion remains the biggest obtaining to-date by the distributed computing behemoth. While the arrangement made them question why Salesforce online training would pay right around 22 times incomes, all around, experts were overwhelmingly positive about the arrangement.

Industry investigators like Ray Wang of Constellation Research guessed that the securing was about a "microservices future," while monetary examiners like Michael Nemeroff of Credit Suisse set that it was about "heterogeneous information situations."

There's some reality to both, as this Coca-Cola online course illustrates. Not exclusively does their utilization case comprise of incorporating inheritance information with more present day information sources, it likewise indicates Coca-Cola's invasion into a microservice-based engineering by making a few layers of APIs from its information sources utilizing MuleSoft.

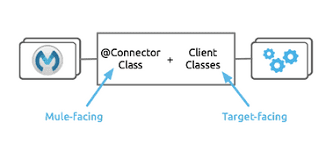

In spite of the fact that the agreement is by all accounts that the securing was for the most part to exploit MuleSoft's API Management abilities, a fast investigation of MuleSoft's client reference stories (see Figure 1) demonstrates that the greater part of utilization cases include joining of inheritance information sources with Salesforce and giving a 360-degree perspective of their tasks by utilizing extra Salesforce online training Bangalore items.

Mulesoft Customer Case Study Categories

Figure 1: MuleSoft client contextual investigations by utilize case. Sourced from MuleSoft.com

While there are some covering contextual investigations in a portion of the classifications, the number is minute to the point that the effect of twofold including does not detract from the reality incorporating heritage information sources with Salesforce is the essential utilize case.

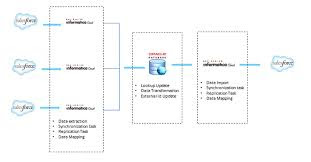

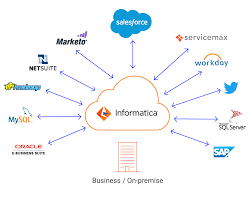

Informatica's Salesforce Partnership Gets Complicated

There's most likely that MuleSoft's securing by Salesforce puts Informatica's association with Salesforce, particularly for its Informatica Cloud product offering (now alluded to as Informatica Intelligent Cloud Services) into danger. As per Gartner's Magic Quadrant for Enterprise Integration Platform-as-a-Service, income for Informatica Intelligent Cloud Services in 2016 was $125 million, and about $190-$200 million out of 2017. This speaks to development rates of 40% from 2015 to 2016 and more than half from 2016 to 2017.

All over, looking at the Salesforce online training obtaining of MuleSoft (which was 21 times incomes), no doubt if Informatica Cloud were a different organization, it would be worth somewhere in the range of $4-$4.2 billion.

Here's the place things get dim.

It is almost certain that a significant bit of Informatica Cloud's incomes is gotten from the Salesforce biological community, given that Informatica's first enormous push into the AWS environment just occurred in late 2014, and real activities with other cloud stage sellers, Microsoft Azure, and Google Cloud Platform pursued considerably later.

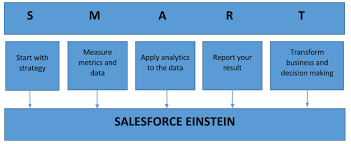

In the $5.3 billion obtaining by the private value firm, Permira in 2015, both Salesforce and Microsoft joined as financial specialists only preceding the arrangement shutting, in spite of the fact that it isn't recognized what level of Informatica each organization possessed. Considering that Salesforce online course Bangalore had reported its Analytics Cloud item (now rebranded as Einstein Analytics) just a half year before the Permira securing declaration, it is very conceivable that it saw Informatica Cloud as an essential ETL accomplice in helping it rival the more extensive undertaking BI showcase.

Quick sending to 2018 in any case, the way that Salesforce burned through $6.5 billion to get MuleSoft in spite of MuleSoft relapsing in the standings for the 2018 Gartner Magic Quadrant for Enterprise iPaaS gives us three key takeaways:

Salesforce online course does not view iPaaS capacities as a basic empowering influence to its development as a stage

Salesforce has surveyed that it is just equipped for accomplishing a specific roof with its Einstein Analytics item and that Informatica Cloud can't resist in transcending that level

Salesforce is organizing application joining and API Management over information mix and ETL in extending its impression as a noteworthy cloud stage

Each of the three takeaways don't look good for Informatica Cloud's development inside the Salesforce biological system.

A Potential Exit — Acquisition by Microsoft

Microsoft has been on a purchasing gorge generally, with its $7.5 billion obtaining of Github on an expected $300 million in incomes speaking to a 25X different.

Back in August 2016, Informatica expressed that it anticipates that its valuation will twofold to $10 billion by 2021, with a conceivable IPO in 2019. For this to happen, Informatica's general incomes (not only incomes from its Intelligent Cloud Services) should be significantly higher, and also develop at a considerably quicker rate than when Permira took it private in August 2015. While there is no data about Informatica's incomes as far back as its last openly detailed figures for 2014 ($1.05 billion), amid the 2018 Informatica World occasion, it was tweeted that the organization burned through $196 million in R&D adding up to 17% of income.

#INFA2018@Informatica puts right around 17% of incomes into R&D = $196 Million! Bravo!! #BBBT

— Claudia Imhoff (@Claudia_Imhoff) May 22, 2018

We can unquestionably deduce from this tweet Informatica's aggregate incomes for 2017 were around $1.153 billion. This would speak to an income gain of about $103 million more than 3 years, or a normal development of around 3.27% every year. Taking a gander at past yearly income figures for Informatica, the year-over-year income development has surely backed off in the previous three years when contrasted with the years going before 2014.

This means the greater part of Informatica's incomes are as yet fixing to its on-premises ETL contributions. The bigger takeaway is that the market for bundled ETL instruments, regardless of whether in on-premises frame or as an iPaaS has a roof, and that roof is quickly drawing nearer for Informatica.

If we somehow managed to risk a figure with respect to what problematic power is hampering the development of ETL apparatuses, we have to look no more distant than Apache Spark. The ongoing coalition between Microsoft Azure and Databricks indicates how enthusiastic Microsoft was to build up a joint item with Databricks and that it puts stock in Apache Spark increasing the value of Azure's information related contributions, for example, Stream Analytics, Cosmos DB, and SQL Datawarehouse. The underneath demo by Databricks amid a Microsoft Connect gathering shows how to do everything from information ingestion to joins - capacities that disintermediate the estimation of ETL sellers like Informatica.

With the estimation of ETL instruments rapidly lessening and 66% of business analysts determining a retreat by 2020, the window is shutting for Informatica (and its private value proprietors, Permira) to make a leave methodology. Microsoft would be an extremely feasible acquirer and it has demonstrated that it isn't hesitant to burn through billions of dollars purchasing innovation organizations that it considers as basic to its future as an undertaking cloud organization.

What the correct obtaining cost would be is available to discuss, and to risk a figure, it is fascinating to investigate a portion of the huge annuity finances who have Permira in their portfolio. Taking a gander at CalPERS, the California Public Employees Retirement System, one can see the Investment Multiple of its past Permira property, and also the current Permira finance that contains Informatica, Permira V.

CalPERS Private Equity Program Fund Performance Review - Permira

Figure 2: CalPERS Private Equity Program Fund Performance Review. Sourced from: Calpers.ca.gov

In the event that the present Investment Multiple of 1.3X is to be kept up, we can securely accept that Permira needs to offer Informatica for in any event $6.89 billion. On the off chance that they are sufficiently fortunate to come to the various of 1.7X from the past Permira Europe III store, at that point they would have the capacity to offer Informatica for $9.01 billion.

For an offer of this extent to occur, Informatica needs to understand that like how Salesforce utilizes MuleSoft to quicken the reconciliation of inheritance information sources into Salesforce online training, Informatica needs to quicken the offloading of heritage databases into Microsoft Azure. Informatica additionally needs to go above and beyond and enable its clients to achieve another method for doing ETL — through Databricks and Apache Spark on the grounds that doing as such would just outcome in more Azure utilization — and that would get the consideration of Microsoft while at the same time helping Informatica jump its current ETL rivals towards a solid exit.

Disclaimer: The above article is the feeling of Lero Labs, LLC and ought not be translated as money related or legitimate exhortation. The writer of this article, Ashwin Viswanath is the Founder of Lero Labs, LLC and already worked at Informatica. No installment was given by Informatica or some other element to compose this article.It is one of the most blazing types of curry consistently accessible, significantly more blazing than the vindaloo, utilizing a substantial number of ground standard bean stew peppers, or a more sultry sort of bean stew, for example, scotch hat or habanero. Commonly, the dish is a tomato-based thick curry and incorporates ginger and alternatively fennel seeds.